2016 Anti-Money Laundering/Countering the Financing of Terrorism (AML/CFT) Awareness Seminar and Training Workshop

The Nevis Financial Services (Regulation and Supervision) Department (NFSD) held its annual Anti-Money-Laundering/ Countering Financing of Terrorism (AML/ CFT) Awareness Seminar and Training Workshop on 21st and 22nd March 2016 at the Four Seasons Resort, Nevis.

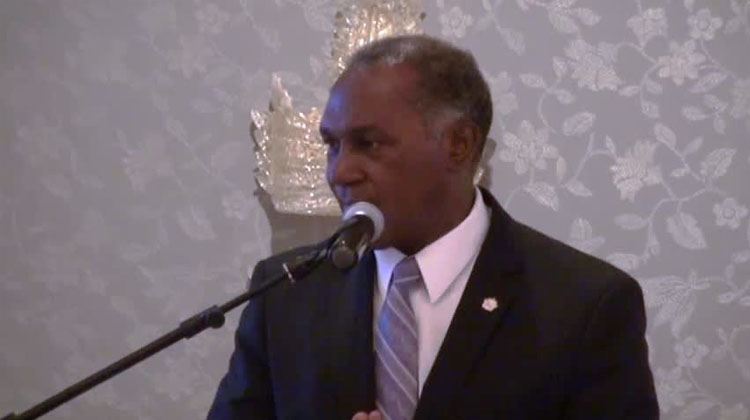

Read MoreNevis Premier addresses participants at AML/CFT Seminar and Training Workshop

Premier of Nevis and Minister of Finance Hon. Vance Amory expressed hope that participants at the 11th annual Anti-Money Laundering (AML)/Counter Financing of Terrorism (CFT) Seminar and Training Workshop, would come up with practical solutions on what else small developing countries could do to find their feet in the international arena, provide jobs for their people and revenue for development.

Read MoreFebruary 2016 Newsletter – New Standard of Supervision

The Group of International Finance Centre Supervisors (“GIFCS”) first issued a Best Practice Statement on the supervision of Trust and Corporate Service Providers (“TCSPs”) in 2002. Since then GIFCS member countries have used this Statement as a benchmark for establishing regulatory frameworks and supervisory practices for the robust oversight of the sector. A key objective of this initiative has been to ensure that TCSPs are adequately regulated and supervised and that information on the ultimate beneficial owners behind trust and company vehicles administered from GIFCS centres, as well as on the sources and nature of underlying funds can at all times be accessed by competent authorities.

Read MoreFATF Public Statement – 19 February 2016

The Financial Action Task Force (FATF) is the global standard setting body for anti‐money laundering and combating the financing of terrorism (AML/CFT). In order to protect the international financial system from money laundering and financing of terrorism (ML/FT) risks and to encourage greater compliance with the AML/CFT standards, the FATF identified jurisdictions that have strategic deficiencies and works with them to address those deficiencies that pose a risk to the international financial system.

Read MoreFATF Notice: Improving Global AML/CFT Compliance: on-going process – February 2016

As part of its on-going review of compliance with the AML/CFT standards, the FATF has to date identified the following jurisdictions which have strategic AML/CFT deficiencies for which they have developed an action plan with the FATF. While the situations differ among each jurisdiction, each jurisdiction has provided a written high-level political commitment to address the identified deficiencies. The FATF welcomes these commitments.

Read More