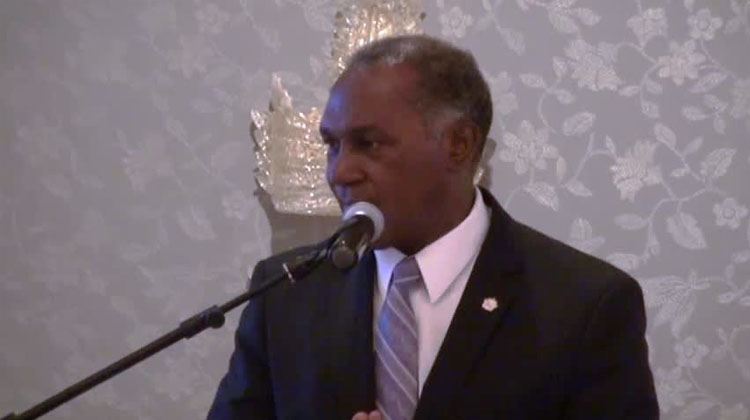

NIA CHARLESTOWN NEVIS (MARCH 22, 2016) — Premier of Nevis and Minister of Finance Hon. Vance Amory expressed hope that participants at the 11th annual Anti-Money Laundering (AML)/Counter Financing of Terrorism (CFT) Seminar and Training Workshop, would come up with practical solutions on what else small developing countries could do to find their feet in the international arena, provide jobs for their people and revenue for development.

Mr. Amory made the comment when he delivered an address at the seminar’s opening ceremony at the Four Seasons Resort on March 21, 2016. The two-day conference is hosted by the Nevis Financial Services (Regulation and Supervision) Department at the Four Seasons Resort. The theme is “Powerful Insights, Practical Ideas, Real Solutions: Financial Crime Prevention – the Way Forward”.

“We are here to do exactly what the theme says, get the insights; look at practical ideas to make what we do better, make it more efficient, make it more profitable and also to find those solutions so that we in the jurisdictions which we utilise and which we are an integral part of, can make our jurisdiction profitable for yourselves, profitable for the government and benefit the people of our jurisdictions,” he said.

He noted that Nevis, along with other Caribbean jurisdictions, continue to face challenges and threats every year from the Global Forum, the USA and the European Union, who seek to impose their policies because of the island’s involvement in international financial services.

Meantime, Regulator at the Department Heidi-Lynn Sutton, in remarks spoke of the importance of this year’s workshop and told practitioners they had a vested interested in protecting the jurisdiction.

“We all have an interest in ensuring that our integrity stays intact and that our financial services products, services and intermediaries are not used as channels to facilitate financial crime.

“The achievements and accomplishments of our jurisdiction as an international financial centre rests with all of us,” she said.

According to the Nevis Regulator, illicit actors manipulate and utilise financial institutions in order to launder their proceeds of crime and their methods have become increasingly sophisticated and elaborate.

“The use of financial services products offered by international financial centres are becoming more attractive. Hence, the more reasons for us as regulators, law enforcement agencies, board and senior management of financial institutions, registered agents, insurance companies, money services businesses, law and accounting firms, to be more vigilant and work more closely together to discover, dislocate and dissuade criminal activity,” she said.

According to Sutton, the scope of the annual training event is boarder this year and includes discussions on the wider and more comprehensive topic of financial crime.

The issue of criminal capital and the new model of financial crime or money laundering would be examined and the importance of human factors where compliance is concerned.

The Regulator acknowledged that cooperation between the regulator and the regulated is vital and the Department recognises the importance of education and training of regulated entities in current trends. She indicated that participants would be shown practical measures they could take to minimise risk.

Sutton said most of the participant are at the forefront of the war against financial crime in their individual institutions and understood the global nature of the problems which threaten the reputation of Nevis as a well-regulated jurisdiction.

Other remarks were made by Permanent Secretary in the Ministry of Finance Colin Dore.